Energy storage, that is, the storage and utilization of energy. Power energy storage is an important component and key supporting technology for smart grids, renewable energy and other types of independent power generation systems, and smart homes.

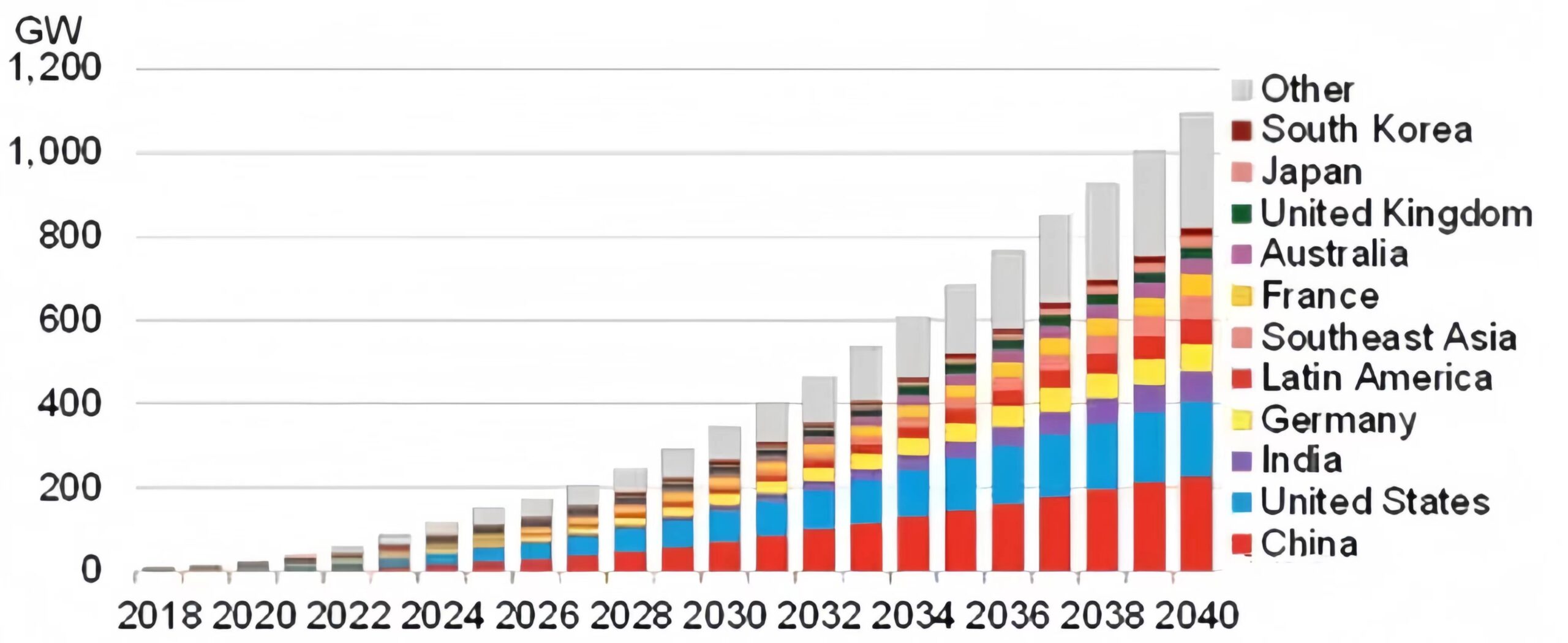

According to the latest forecast from Bloomberg New Energy Network (BNEF), global energy storage installed capacity (excluding pumped hydro) will grow exponentially, with an expected compound annual growth rate of 31% until 2030. By 2040, total global energy storage deployment will increase from 9GW/17GWh in 2018 to 1,095GW/2,850GWh.

If the average system cost is 1Wh = 0.3 US dollars, the total market volume should be no less than 800 billion US dollars. Below we mainly analyze the current status of the energy storage market in Brazil, Mexico, Chile, and Colombia.

Economic environment

Brazil: It has a huge economic aggregate and population base, high per capita electricity consumption, low power grid coverage, and frequent power outages.

Mexico: The economic aggregate is second only to Brazil, the per capita national income is high, the electricity consumption is medium, and the power infrastructure is relatively complete.

Chile: Per capita GDP and electricity consumption top the list, with high power grid coverage, but frequent power outages.

Colombia: The population and economic aggregate are high, the per capita electricity consumption is low, and the power infrastructure is relatively backward.

Policy Environment

Brazil: There is a green certificate transaction; there is no investment tax deduction; some equipment is tax-free; net metering electricity charges are implemented for distributed and household, industrial and commercial small power stations; there is no FiT; there is a time-of-use electricity price.

Mexico: There are green certificate transactions; there are investment tax credits and equipment tax exemptions; net metering electricity rates are implemented for distributed and household, industrial and commercial small power stations; there is no FiT; there are time-of-use electricity prices.

Chile: There is no special incentive policy for large-scale power station investment; there is grid-connected electricity sales guarantee for distributed power stations; there is Net-metering for household and small industrial and commercial photovoltaics, and there is no FiT.

Colombia: There are preferential policies for investment in large power stations; grid-connected electricity sales are guaranteed for distributed power stations; Net-metering and FiT are available; there is no time-of-use electricity price.

Market environment

Brazil: The huge installed capacity of new energy sources implies huge demand for energy storage on the power supply side. Electricity prices are moderate, and industrial and commercial energy storage has limited profit margins. Conventional hydropower accounts for nearly 65%, followed by gas, followed by wind energy (15GW) and photovoltaic (7.4GW).

Mexico: The huge installed capacity of new energy means huge demand for energy storage on the power supply side. Industry and commerce, especially commercial electricity prices, are relatively high and there is a certain demand for industrial and commercial energy storage.

Chile: The installed capacity of new energy is relatively large, and there is a certain demand for energy storage on the power supply side. Electricity prices and expenditures are high, and the economic benefits of household and industrial and commercial energy storage are obvious.

Colombia: The installed capacity of new energy is small, the geographical distribution is relatively even, and there is potential demand for distributed energy storage. There is a tiered electricity price mechanism (the more electricity is used, the more expensive it is), and the time-of-use electricity price policy is being formulated, and there is a certain demand for household and industrial and commercial energy storage.

Summarize

Brazil:

The market is huge, electricity costs account for a high proportion of national income, new energy power installed capacity is growing rapidly, corresponding to the potential demand for large-scale energy storage on the power generation side; weak power infrastructure, frequent power outages and time-of-use electricity prices correspond to potential industrial, commercial and household needs. usage, and off-grid energy storage needs.

The power generation and transmission businesses are basically state-owned, and power market mechanisms that are beneficial to grid-side frequency regulation energy storage, such as capacity trading and scarce electricity prices, have not yet been formed. New energy investment incentives and tax exemption policies are relatively unstable and have large regional differences.

Battery import taxes are high. Combined with the new energy power installed capacity target, it is expected that the total demand for Brazil’s energy storage market will reach 20GW / 50GWh by 2030, most of which will be power generation side energy storage.

Mexico:

The market size is large, the policy environment for new energy investment is good, and the proportion of new energy installed capacity is high, corresponding to the potential demand for large-scale energy storage on the power generation side; high commercial electricity prices and time-of-use electricity price mechanisms are positive factors for industrial and commercial energy storage demand.

For the same reason as Brazil, there is a lack of market mechanisms conducive to grid-side frequency regulation energy storage. It is expected that by 2030, the total demand for Mexico’s energy storage market will reach 12GW/30GWh, most of which will be power generation side energy storage.

Chile:

Chile’s economic foundation is solid, its legal system is sound, and the risk coefficient of large projects is low. The electricity market is thoroughly privatized, policies and regulations are transparent, and the project development environment is good. With the substantial increase in the proportion of new energy, the market demand for energy storage on the power generation side and transmission and distribution side is huge.

High electricity prices (close to the European average) ensure the market and profitability of household and industrial and commercial energy storage. However, due to the gap between the rich and the poor, Chile’s household energy storage market is small. The existing PMDG electricity sales guarantee policy is not conducive to the popularization of energy storage applications in distributed photovoltaics. By 2030, the total demand for Chile’s energy storage market is expected to reach 4GW/10GWh.

Colombia:

Colombia has a high population and economic aggregate (ranking 4th in Latin America), weak power grid infrastructure, no capacity trading mechanism, and strong demand for energy storage on the transmission and distribution side. Renewable energy resources are distributed evenly, and there are clear policies to encourage new energy investment, which is conducive to the development of distributed energy storage projects.

The national economy is growing rapidly, the electricity price level is relatively high, and there are tiered electricity prices and time-of-use electricity price mechanisms, which are positive factors for the market development of household, off-grid, and industrial and commercial energy storage. By 2030, the total demand for Colombia’s energy storage market is expected to reach 2GW/4.5GWh.

According to BNEF’s latest forecast, the installed capacity of energy storage in the entire Latin American market is expected to reach 40GW/100GWh by 2030. For more industry updates, stay tuned for updates on the website or follow our social media accounts.