2022 is a year for the rapid development of energy storage batteries in my country, and it has achieved “double firsts”, that is, the growth rate of annual shipments is the first, and the number of power energy storage battery delivery projects is the first. In 2023, the industry will still show a trend of maintaining rapid growth, and the market size is expected to exceed 100 billion.

Overview of the status quo of the energy storage battery industry in 2022

Shipment and market classification

From 2020 to 2022, the shipment of energy storage batteries in China will grow rapidly.

Especially after the geopolitical conflict between Russia and Ukraine triggered the European energy crisis and the reform of the domestic power market, the shipment of energy storage batteries continued to maintain the strong growth trend of the previous year, with shipments of 130GWh, an increase of 170.8% over the same period of the previous year.

Shipment Market Segmentation:

Electric energy storage batteries – shipments 92GWh, accounting for 70.8%

Household energy storage batteries – shipments of 25GWh, accounting for 19.2%

Communication energy storage batteries – shipments 9GWh, accounting for 6.9%

Portable energy storage batteries – shipments 4GWh, accounting for 3.1%

New installed capacity of energy storage batteries

Thanks to the continuous reduction in battery costs and government policy incentives, the newly installed capacity of energy storage batteries will reach 5.8GWh in 2021, and the compound annual growth rate of newly installed capacity of energy storage batteries will reach 109.7% from 2017 to 2021. In the context of energy transformation and carbon neutral strategy, energy storage batteries are an important part of power system reform and new energy power construction, and energy storage batteries are expected to reach 7.1GWh in 2023.

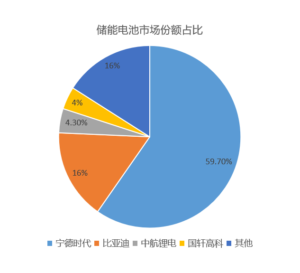

Competition and Investment in Energy Storage Batteries

The competition pattern of China’s power storage battery industry is relatively concentrated, and the head effect is more obvious. Since 2022, leading companies have expanded production and built energy storage battery projects, with an investment of tens of billions, and the energy storage battery industry has shown a trend of investment expansion. The market shares of leading companies are as follows:

Development Prospects of Energy Storage Battery Industry

“Double carbon” boosts industrial development

In view of the goal of “double carbon”, increasing the pace of new energy promotion has become the general trend. Due to the randomness of new energy generation, power instability, and difficulty in grid connection, the development of new energy storage technologies has become more important. The National Development and Reform Commission and the National Energy Administration jointly issued the “14th Five-Year Plan” New Energy Storage Development Implementation Plan, proposing that by 2025, new energy storage will enter the stage of large-scale development. This has brought a development opportunity for my country’s energy storage battery industry. In the future, my country’s energy storage batteries will occupy a dominant position in new energy storage products.

5G base stations drive industrial demand

As the key infrastructure of 5G communication, 5G communication generally adopts micro/macro duplex mode. Due to the higher energy consumption of 5G network compared with 4G, macro base stations put forward higher requirements for the energy density of lithium batteries. Inside the macro base station, the energy storage battery is used as a backup power supply to help manage peak shaving and valley filling. The “14th Five-Year Plan for the Development of the Information and Communication Industry” put forward the goal of having 26 5G base stations per 10,000 people by 2025. Based on China’s 1.4 billion people, it is estimated that my country will build more than 3.6 million 5G base stations. 5G base stations have entered a period of large-scale centralized construction, and the demand for energy storage batteries will increase sharply.

Battery cost-effective growth is the main driver

Lithium-ion batteries are increasingly cost-effective, and their installed costs are expected to continue to decline until 2030. In China, the falling cost of lithium-ion batteries has led to electrochemical energy storage being the main driver of energy storage capacity growth, making lithium-ion batteries a more viable alternative to natural gas-fired power plants in several major energy markets. This growth is expected to drive the rapid expansion of the energy storage battery market. It is expected that the shipment will exceed 60GWh, and the market size will reach 100 billion yuan, which will eventually become the main driving force of China’s energy storage industry.