Development status

Europe was the first region to propose energy transformation and has always regarded “becoming a leader in global energy transformation” as the driving force for its development strategy and policy implementation. As European countries accelerate the adjustment of their energy structure, the household energy storage market is developing rapidly, showing a European electrochemical household energy storage market pattern with Germany and the UK leading the way, and Italy, France, Austria and other countries growing rapidly.

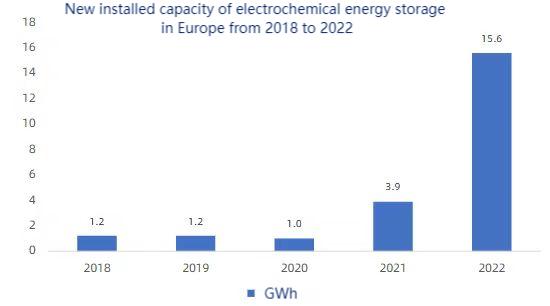

At present, the electrochemical energy storage market has become an important channel for Europe to reduce its dependence on external energy and achieve green transformation. From 2018 to 2022, the cumulative installed capacity of electrochemical energy storage systems in Europe will increase year by year. According to data from the European Energy Storage Association (EASE), the newly installed capacity of electrochemical energy storage in Europe in 2022 will be 15.6Gwh.

European household energy storage demand continues to boom

According to the application scenarios of electrochemical energy storage, it can be divided into power generation and power grid, as well as household and industrial and commercial. Europe is currently the largest household energy storage market in the world.

In the second half of 2021, the energy crisis swept the world, and wholesale electricity prices in Europe continued to rise rapidly. At the end of 2021, new contract electricity prices for European residents also began to rise significantly accordingly.

According to data from the Energy Price Index website, in January 2022, the residential electricity price in Berlin, Germany, rose to 0.5 euros/kWh, a year-on-year increase of more than 50%. The Russian-Ukrainian conflict that broke out at the end of February 2022 caused European natural gas prices and power futures prices to fluctuate at high levels. At the same time, the risk of Russian natural gas supply cuts has also increased European countries’ concerns about energy security. According to data from the Energy Price Index website, in November 2022, the electricity price for residents in many European capitals still exceeded 0.5 euros/kWh.

The continued rise in electricity prices has promoted the rapid development of household energy storage in some countries and regions, of which Germany is a typical representative. According to German BVES report data, by the end of 2021, the total sales volume of German household energy storage units was 430,000 units, with an increase of 145,000 units, a year-on-year increase of 45%. Affected by the impact of the Russia-Ukraine conflict on energy prices, household energy storage demand has further accelerated growth recently. The report predicts that German household energy storage will add 270,000 units throughout the year in 2022, a year-on-year increase of 86%.

At the same time, nearly 86% of respondents rated the residential energy storage market outlook in 2022 as “very positive” or “fairly positive.”

Household light-storage integration and secondary storage will become an important development trend

To maintain the advantages in the household energy storage market, household integrated light and storage projects have become mainstream

As photovoltaic continues to develop and its penetration rate steadily increases, household photovoltaic storage integration is expected to become the mainstream direction of household photovoltaic development in European countries. Europe is accelerating its energy transition to enhance energy independence, and rooftop photovoltaics are gradually becoming a mandatory policy requirement. In May 2022, the European Union REPower EU proposed to implement the “Rooftop Solar Plan” to install solar panels in new public and commercial buildings and residences in phases.

As photovoltaic penetration increases, Europe is expected to face a net load “duck-shaped” curve problem similar to that of California in the mid-to-long term. Due to the natural time mismatch between household photovoltaic power generation and residential electricity consumption, household photovoltaic storage integration is expected to become a Important trends in the European market.

Energy storage construction and economic benefits develop in parallel, and secondary reserves have become a new profit point

The secondary reserve, also known as automatic frequency recovery reserve (aFRR), is designed to restore the grid operating frequency to standard values, requires a longer activation time, and requires an energy storage system with a continuous discharge time of 2-4 hours. At present, European energy storage, especially battery energy storage, is basically unable to provide non-frequency auxiliary services such as voltage control and black start, and the source of revenue is relatively single. Based on this, the European market is actively exploring new sources of income, and secondary reserves will become the main growth point of future off-balance sheet energy storage income.

In the future, European energy storage will prioritize improving the energy and reserve markets, and then gradually improve other non-auxiliary service markets. The secondary reserve revenue model provides a combination of reservation payments and activation payments. Europe will continue to give full play to the advantages of household-side energy storage, and the integration of household light and storage and secondary storage will become an important development trend.

To learn more about the energy storage market, stay tuned for more updates on the website or follow MK Energy’s social media accounts.