El despliegue de energías renovables en los países del Sudeste Asiático se ha convertido en una demanda rígida

According to the International Energy Agency (IEA), the GDP of Southeast Asian countries has doubled since the beginning of this century. At the same time, energy demand is increasing by about 3% annually. In line with the Paris Agreement goals, six countries in the ASEAN region have committed to achieving net zero targets in the future. Southeast Asian countries must deploy about 21GW of renewable energy annually by 2030, with wind and solar photovoltaics accounting for 18% of electricity generation, reaching 44% by 2050.

Philippines: “Privatization + Free Competition,” the almacen de energia El potencial del mercado eléctrico se ha duplicado.

*Currently,70% of the electricity in the Philippines relies on fossil energy. However, fossil resources are scarce and are mainly imported from Indonesia, Australia, etc., so electricity resources are in short supply. In addition, the Philippines has a total of 7,101 islands. Frequent natural disasters such as typhoons prevent remote islands from connecting to the power grid. Therefore, the Philippine power supply market has become an urgent need for energy storage.

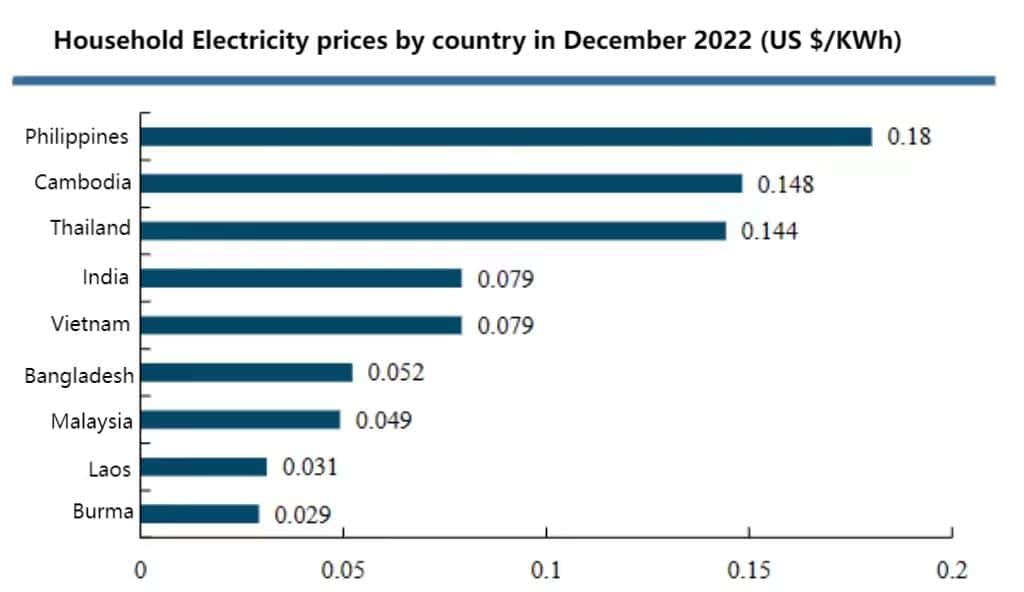

*En la actualidad, el coste de la electricidad en Filipinas es elevado. El precio medio de la electricidad para los residentes en diciembre de 2022 asciende a $0,18/KWh. También hay una grave escasez de energía en el país y la demanda de almacenamiento de energía es inminente. Según el Plan Nacional de Desarrollo Energético de Filipinas, Filipinas acelerará la construcción de energía renovable en el futuro y se espera que configure 6 GW de almacenamiento de energía.

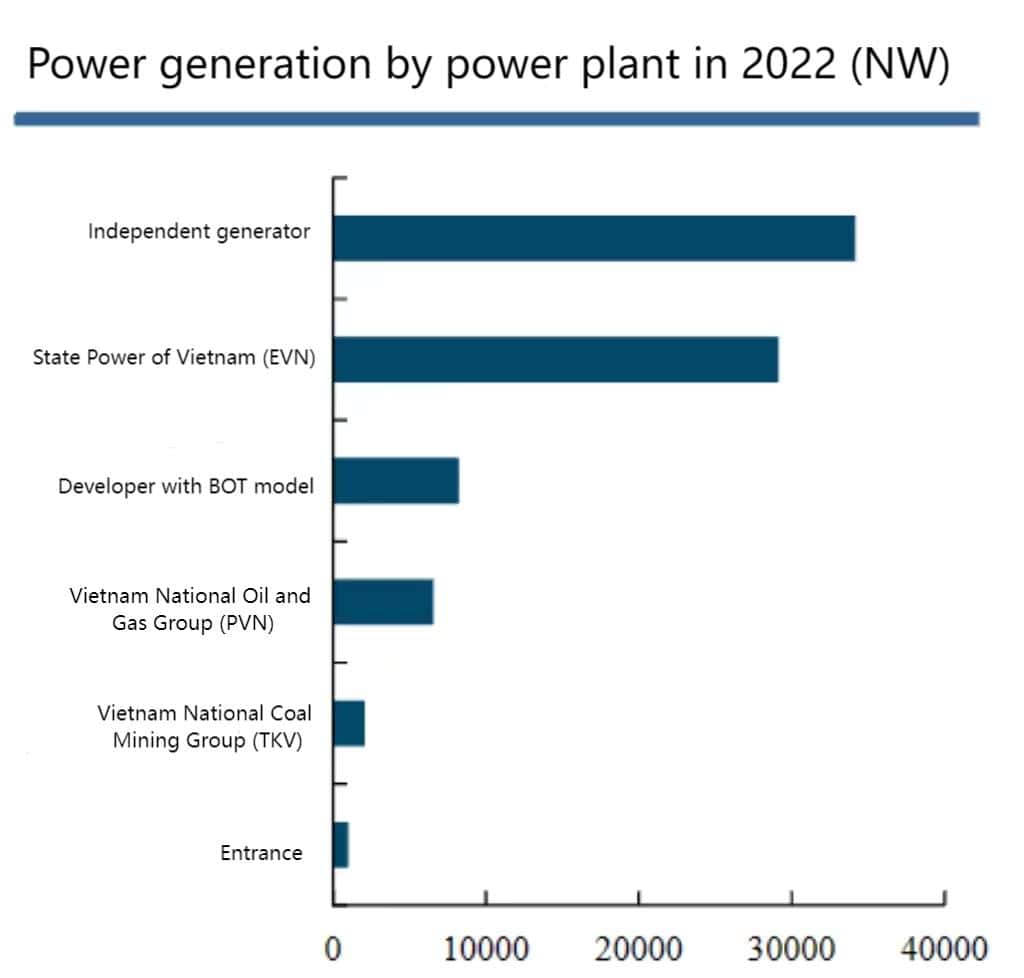

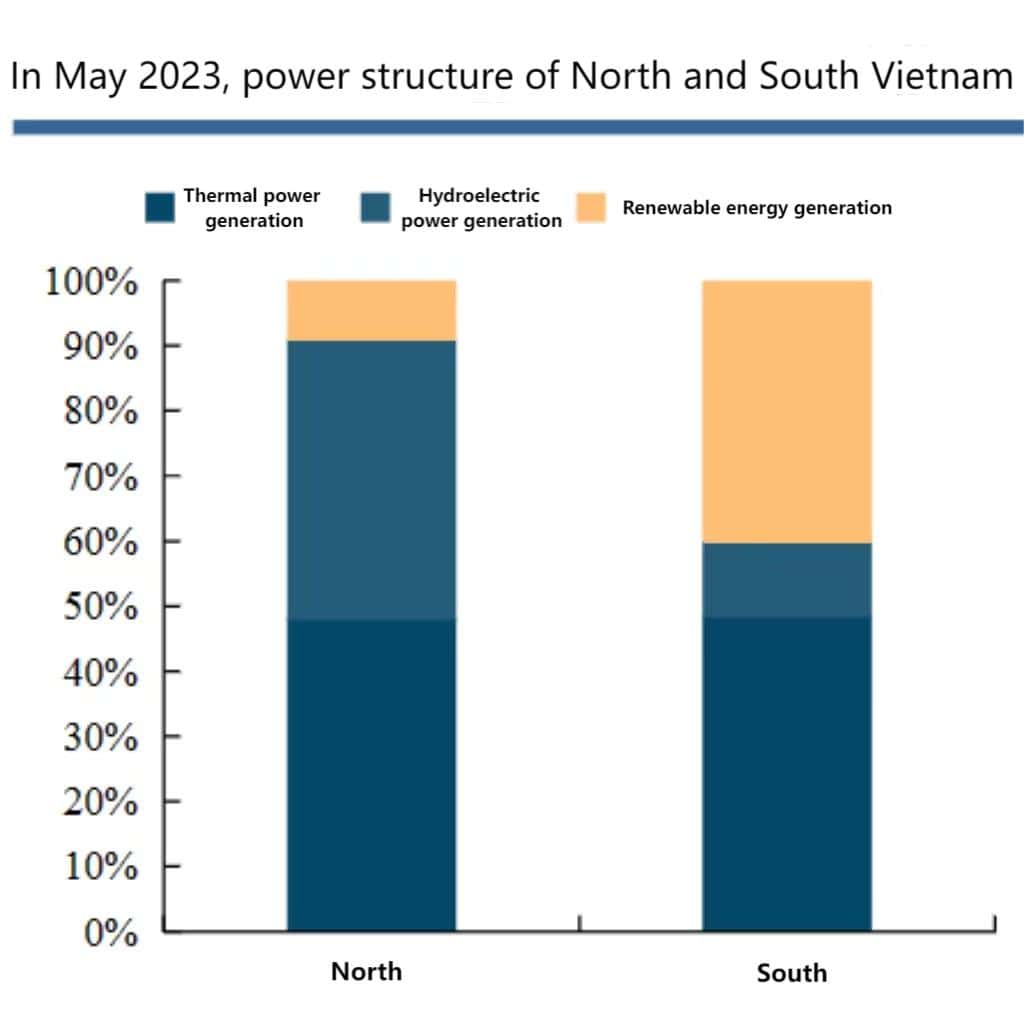

Vietnam: el poder del Sur no puede transferirse al Norte, lo que crea oportunidades de almacenamiento de energía

*Hydropower and coal power are relatively developed in northern Vietnam, and power types are diversified. However, hydropower stations in the north will almost dry up in 2023. The average dispatch will be reduced by 50% compared to 2022, accounting for about 12%-15% of power generation, while the remaining water in the south will be based on the peak The electricity consumption standard is only enough for four days. Secondly,48% of the coal-fired power plants in the north continue to operate due to high temperatures, and their machine capacity is reduced. As a result, the power supply in the north exceeds demand, and production is suspended. In the future, energy storage needs will be put on the agenda.

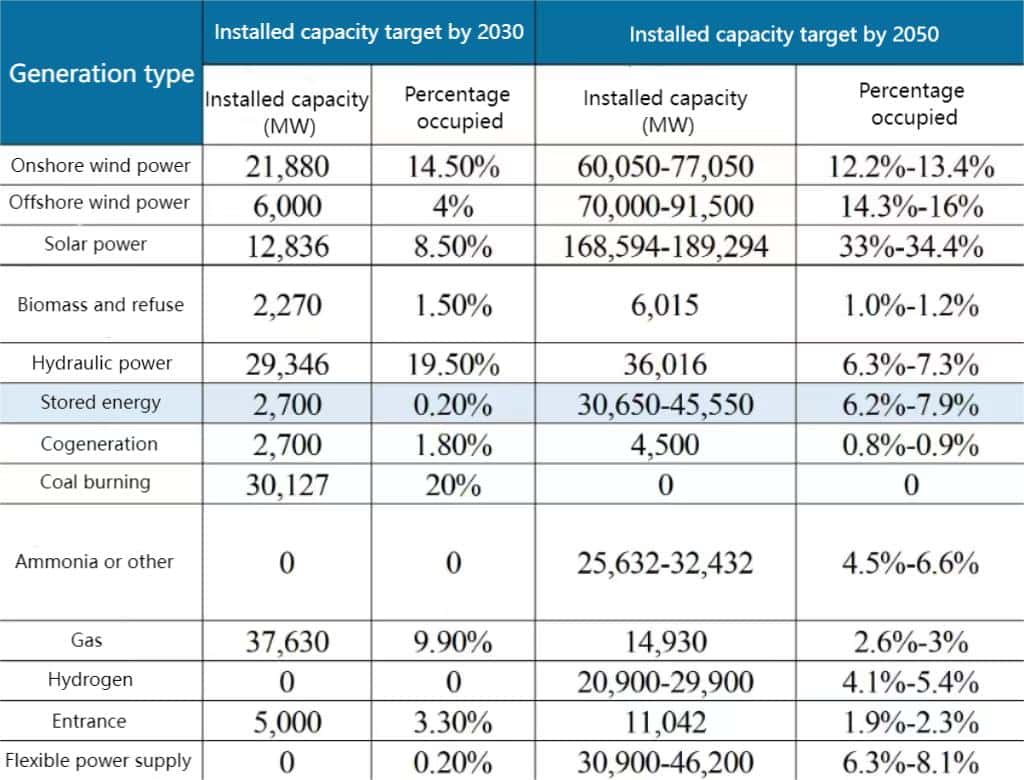

*In May 2023, Vietnam released the Eighth Power Development Plan (PDP8), intending to stop the development of new coal power projects by 2030 and the use of coal-fired power generation by 2050. By 2030, Vietnam’s photovoltaic power stations will increase to 12GW, and energy storage will increase to 2.7GW.

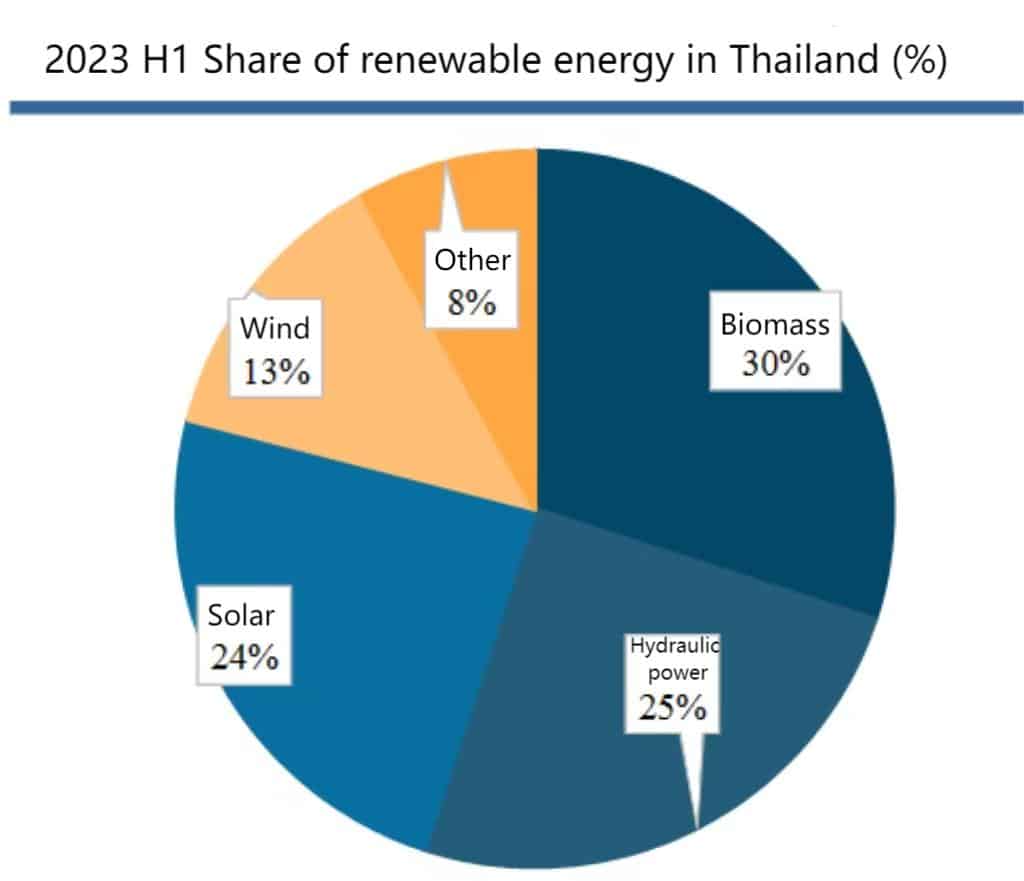

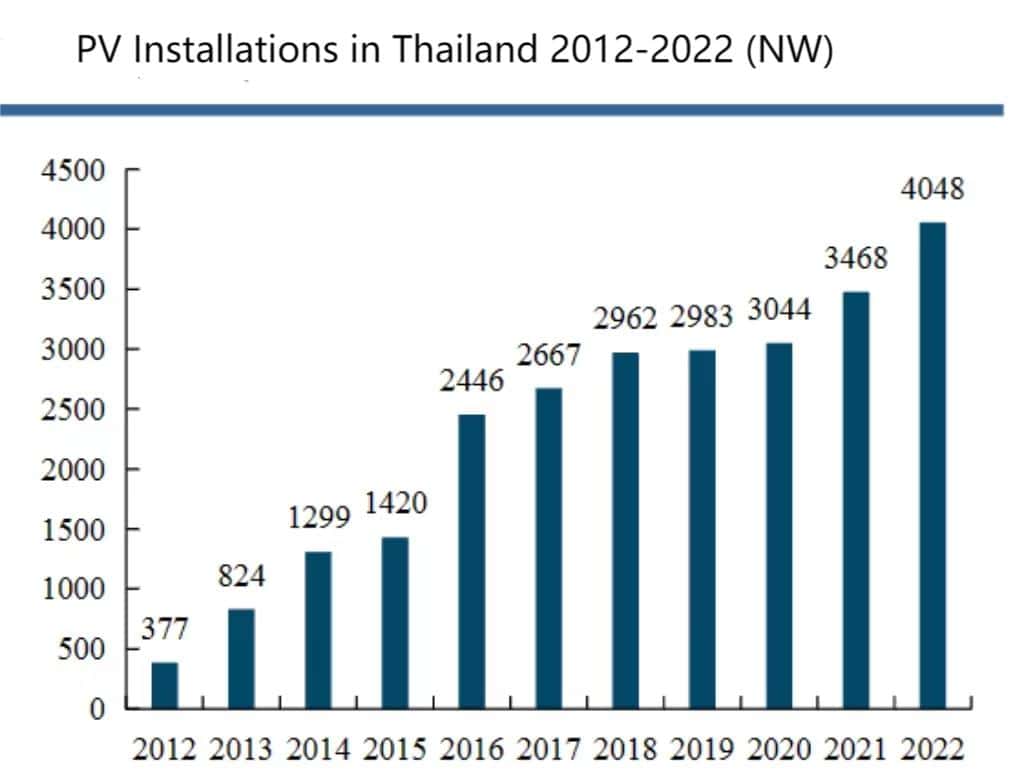

Tailandia: La planificación paisajística y solar impulsará inevitablemente la demanda de almacenamiento de energía

*According to 2018 Global Energy Team data, Thailand has insufficient natural gas reserves, poor coal quality, and a significant gap in electricity demand, with about 13% relying on imports. Therefore, the electricity price is around US$0.12/kWh, which is relatively high among Southeast Asian countries.

*Southern Thailand is rich in wind resources, but the most developed power grid area is in the central Bangkok economic circle, and the connection with the southern power grid is weak. If wind power is to be vigorously developed, energy storage is the only way to solve the problem of the south of power grid.